Financial Strategy Is the Missing Link in Business Growth.

“82% of businesses fail due to poor cash flow management.”, CB Insights: Top Reasons Startups Fail

Many startups and small businesses don’t fail because their ideas are bad. They fail because they do not handle their money properly. If cash flow keeps changing and budgets aren’t planned, business growth slows down. Sometimes it stops altogether. That’s where Fractional CFO Services make a difference.

A fractional CFO gives you senior-level financial strategy without the cost of a full-time hire. They help you make better decisions and manage risk. They also help you plan for growth. If you’re raising funds or scaling up, this kind of support can be the difference between moving forward or falling behind.

And if you’re not ready to bring someone on full-time, you can hire a fractional CFO on a flexible basis just when you need them most.

This article shows how a fractional CFO helps businesses grow faster and make smarter financial decisions.

What Is a Fractional CFO, Really?

Understanding Fractional CFO Services

A fractional CFO is basically like having your own finance wizard, but just for the hours you actually need. You get legit high-level financial advice, but you’re not stuck with a full-time salary or Day-to-day HR obligations. It is ideal if you’re a startup or your business is growing rapidly and you need serious financial guidance (but not a full-time CFO). You have the flexibility to seek help only when you actually need it, then relax the rest of the time.

It is a boss-level finance help, no massive commitment. High impact. No drama. Just what your business needs, when you need it.

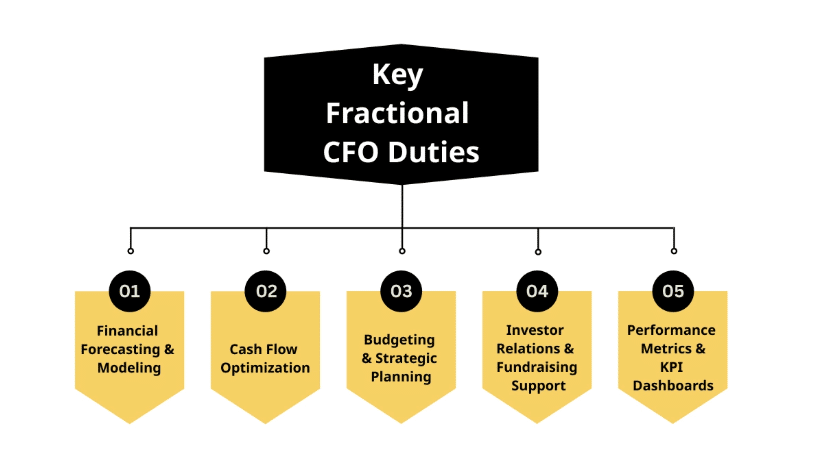

What Does a Fractional CFO Actually Do?

- Financial forecasting and modeling: They jump right into your financial chaos, forecasts, models, spreadsheets, and more. They translate your huge data that actually makes sense.

- Cash flow optimization: They keep an eye on your cash, so you don’t lose sleep wondering “should I check my bank account… again?”. They identify weird money leaks and make sure bills get paid on time.

- Strategic planning and budgeting: They don’t just throw numbers around but actually build a budget that backs up your wildest goals. They help form real strategies so your next big idea actually stands a chance.

- Investor relations and fundraising support: They create the reports and pitch decks you need. They also help you speak way more professionally and confidently with investors, even if you don’t feel ready.

These are the core fractional CFO duties. If you’re wondering what a fractional CFO does, this is it. And if you’re thinking about getting help, fractional CFO services are a flexible way to start.

Fractional CFO vs. Full-Time CFO

Hiring a full-time Chief Financial Officer costs a lot. You pay a salary, benefits, and overhead. For many startups, that’s too much. Fractional CFOs give you the same level of expertise, but you only pay for what you need. It’s flexible. You can bring them in for a few hours a week or for a specific project.

They help with financial planning, budgeting, and business consulting without the long-term commitment. That’s one of the key benefits of a fractional CFO. And if you’re in early growth mode, this setup works well for startup finance. You get senior support without stretching your budget.

Here’s a clear, side-by-side comparison table showing the differences between them.

| Category | Fractional CFOs | Full-Time CFO |

| Cost | Pay only for hours or projects needed. No salary, benefits, or overhead. | High fixed salary, benefits, and long-term overhead. |

| Flexibility | Scalable support based on business needs. | Fixed role with limited flexibility. |

| Expertise Access | Senior-level Chief Financial Officer guidance without full-time commitment. | Full-time access to strategic leadership. |

| Financial Planning | Short-term help with planning and forecasting. | Regular support with budgets and reports. |

| Business Consulting | Often includes business consulting and advisory services. | May focus more on internal operations and reporting. |

| Startup Finance Fit | Works well for startups with tight budgets and quick changes. | Fits bigger companies that have steady cash flow. |

| Benefits of a Fractional CFO | Lower cost, more flexibility, and quick access to expert advice. | More stability and a stronger connection to your team over time. |

Strategic Impact

How Fractional CFOs Drive Smarter, Faster Growth

A Fractional CFO doesn’t just manage numbers; they shape strategy. For startups and growing businesses, this kind of support can make a real difference in how fast and how well you grow.

CFO Business Strategies That Scale

Here’s what strong CFO Business Strategies look like in action:

- KPI tracking and performance dashboards: Clear metrics help you see what’s working and what’s not.

- Scenario planning for market shifts: You’re ready for change, not reacting to it.

- M&A readiness and due diligence: You can move quickly when opportunities come up.

These are core parts of Strategic CFO Services, focused, practical, and built for growth.

Benefits of a Fractional CFO for Startups and SMBs

For early-stage companies, the benefits of a fractional CFO go beyond cost savings:

- Make decisions faster with clear data: You get clarity without waiting or guesswork.

- Better investor trust: Your numbers are clear, and your pitch is easy to follow.

- Leaner operations with higher ROI: You spend smarter and grow cleaner.

This is especially true for a fractional CFO for business startups, where every move counts and every dollar matters.

“Companies with CFO-level guidance grow 30% faster on average” , source: McKinsey

Here’s a clear, side-by-side growth curve comparison table showing how businesses typically perform with versus without strategic CFO services.

| Without Strategic CFO Services | With Strategic CFO Services |

| Slow, inconsistent revenue growth | Steady, forecasted revenue acceleration |

| Frequent cash flow issues | Proactive cash flow planning and control |

| Reactive decision-making | Smart planning based on real data |

| Lost chances to raise money or build partnerships | Timely investor readiness and outreach |

| No clear financial roadmap | Defined growth milestones and KPIs |

| High burn rate, low ROI | Optimized spending and resource allocation |

| Stalled scalability | Scalable systems and financial infrastructure |

Use Cases & Industry Fit

Who Should Hire a Fractional CFO?

Not every company needs fractional CFOs, but for the right business, this is a lifesaver. They help Startups looking to grow (and not mess up the money part) and lean teams that need expert advice without paying someone’s entire salary. They also help businesses get ready for investors or when facing big financial decisions.

How Different Industries Use Fractional CFOs

- Tech Startups: Tech startups move fast and spend quickly. They often need help tracking costs and building investor decks. They also need support with financial planning and forecasting. A Fractional CFO helps them stay focused and ready for funding without overspending.

- Dental Practices: Dental clinics deal with insurance payments and equipment costs. They need clear financial systems and smart budgeting. That’s where Fractional CFO Services help bring structure and control to everyday decisions.

- Logistics Firms: Logistics businesses face slim margins and shifting demand. They manage complex contracts with multiple vendors. They need help managing costs and planning their fleet. They also need support with tracking and controlling cash flow. A Fractional CFO brings structure and supports smart growth.

- Sustainability Ventures: Green startups often use grants and support from impact investors. They also focus on lasting results and staying true to their mission. A Fractional CFO helps match their mission with the numbers, tracking things like carbon savings and ESG goals.

How to Hire the Right Fractional CFO

Choosing the Right Strategic CFO Services Partner

Hiring a fractional CFO isn’t just about filling a gap just because someone left. You’re basically finding someone who just “gets” your business vibe and can work well with your team. They’d better speak your industry’s language, not just speak buzzwords, and actually make sense when they talk. If they do not know your system and can’t handle your setup, it will bring new challenges to your business.

Key Qualities That Are Actually Worth Caring About

- Industry experience: Don’t waste your time with someone who’s just written a few articles about your field. You need a CFO who’s seen the inside of a clinic, survived at a startup, or kept a logistics company from catching fire. They should detect problems early, before you even see them coming.

- Communication style: You want someone who speaks clearly and actually listens, rather than planning their next buzzword.

- Tech stack familiarity: Your CFO should totally get your tools. That means ERP systems, BI dashboards, and even those Excel sheets you manage. If tools and technology scare them, that’s your clue to look elsewhere.

- Real Fractional CFO Services, Not Just Throwing Reports: Look for someone who goes beyond handing you a pile of reports. You need actionable advice. Make sure they get involved and actually guide you, not just watch from a safe distance.

If they miss any of these? Keep looking to hire a Fractional CFO. The right CFO isn’t just in it for the title, they’re ready to roll up their sleeves and make a difference with their real Fractional CFO Services.

Questions to Ask Before You Hire

If you’re looking for a part-time CFO, it is something that you can’t take lightly. You want someone who can actually help, not just eat up your budget. Before making any moves, ask them these key questions:

- What are your typical engagement models?

Ask what their billing style is: hourly, monthly, or per project? Because you do not want surprise bills or fuzzy agreements. - How do you measure success?

Ask what results they track. Is it better cash flow, cleaner reporting, or hitting fundraising goals? - Can you share references or case studies?

A good CFO should be able to show how they’ve helped other businesses. Real examples matter. - What tools do you use?

Ask which tools they are comfortable with, such as your ERP, BI dashboard, or any other tools you use. You don’t have to settle, as you need someone who speaks your tech language, not someone who will fumble around.

You’re looking for actual Fractional CFO consulting, not just a spreadsheet expert. These questions help you choose the right partner. If you’re ready to hire a Fractional CFO.

Where to Find Trusted Fractional CFOs

Finding a good fractional CFO takes more than a quick search. You want someone reliable, experienced, and easy to work with. Here are a few places to start:

- Fractional CFO consulting firms: Specialized firms like The Field Group offer Fractional CFO Consulting. We worked with startups, clinics, and growing businesses. You’ll find vetted professionals who know what they’re doing.

- Professional networks: LinkedIn and Toptal are solid options. You can check profiles, read reviews, and see who’s worked with similar companies.

- Industry-specific platforms: Some sites focus on finance talent for certain sectors like tech, healthcare, or logistics. These platforms help you find someone who understands your space.

If you’re looking for real Fractional CFO Consulting, start with trusted sources like The Field Group. It saves time and helps you find someone who fits.

To summarize,

Hiring a CFO isn’t just throwing money at paperwork. You need someone who gets your business, not just the numbers. They should work with your style, not disrupt how things run. They will keep things running smoothly, avoid dumb mistakes, and grow without losing their grip.

What Makes The Field Group Different?

This isn’t just another project for us. We’re here to really help. How? We dig deep and ask real questions, even the difficult ones you might be avoiding. You’ll get hands-on support, not just a PDF full of fluff. We’re not into quick fixes; we want to help you build something that’ll actually stick around.

Curious how this all works? Here’s the next step: Dive into our Fractional CFO Consulting services. Hit us up for a real conversation; it could save you a ton of hassle.

Let’s build something serious.

Source: https://fieldgroupny.com/how-fractional-cfo-helps-businesses-grow-smarter-and-faster/